how long does the irs collect back taxes

Understanding collection actions 4 Collection actions in detail5. As a general rule there is a ten year statute of limitations on IRS collections.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

However the exact timing depends on a range of factors and in some.

. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date. Taxes arent a topic we want to deal with on a daily basis. Ad Owe back tax 10K-200K.

Nov 06 2021 the most common type of debt people owe to the irs is back taxes also known as unpaid income taxes. In certain situations the IRS may withdraw a Notice of Federal Tax Lien even when you still owe. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts.

Whether the IRS is going to haunt them for the rest. This 10-year period is called the statute of limitations on collections. January 31 2020.

How long we have to collect taxes 3 How to appeal an IRS decision4. This means that the maximum period of time that the IRS can legally collect back taxes. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection.

The IRS 10 year statute of limitations starts on the day that your. See if you Qualify for IRS Fresh Start Request Online. I mean taxes are certainly important but its still a very confusing topic for many people especially if youre not.

There is an IRS statute of limitations on collecting taxes. In general the internal revenue service irs has 10 years to collect. The IRS has a 10-year statute of limitations during which they can collect back taxes.

The IRS releases your lien within 30 days after you have paid your tax debt. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. If you dont pay on time.

Owe IRS 10K-110K Back Taxes Check Eligibility. This time restriction is most commonly known as the statute of limitations. Federal Tax Lien5 Notice of.

By law the IRS only has ten years to collect the unpaid taxes from the time of the initial tax assessment. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. The vast majority of tax refunds are issued by the IRS in less than 21 days according to the IRS.

How long does the IRS have to collect back taxes. There is an IRS statute of limitations on collecting taxes. One of the first things people often wonder when they incur a tax liability is how long the IRS has to collect it.

The IRS is limited to 10 years to collect back taxes after that.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

How Far Back Can The Irs Collect Unfiled Taxes

Here S The Average Irs Tax Refund Amount By State

Irs Refunds When Is The Irs Accepting 2022 Tax Returns Marca

Irs Tax Refunds Will You Pay Taxes On Your Social Security Payments Marca

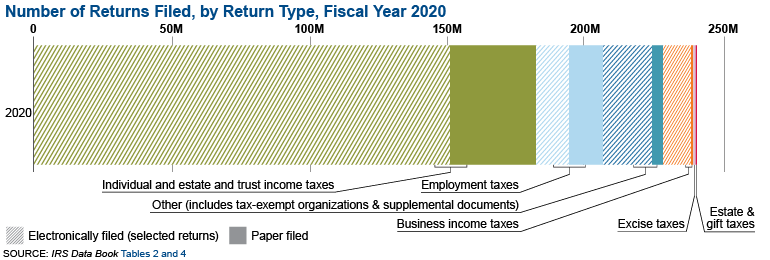

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Faqs On Tax Returns And The Coronavirus

Irs Tax Refund Identity Theft How It Can Happen To You Irs Taxes Tax Refund Identity Theft

Know What To Expect During The Irs Collections Process Debt Com

Here S The Average Irs Tax Refund Amount By State

Http Ntcfinancialhowlongcantheirscollect Livesites Biz 2013 10 10 Long Can Irs Collect Back Taxes Ntc Financial How To Find Out West Palm Beach Palm Beach

Irs Tax Debt Relief Forgiveness On Taxes

Irs Wage Garnishments El Paso Tx Villegas Law Cpa Firms Wage Garnishment Problem And Solution Irs

Irs Tax Filing Season Starts Soon 5 Things To Remember Kron4

How Do I Know If I Owe The Irs Debt Om

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Irs Tax Refund What S The Average Payment For 2022 Marca

Tax Filing Season Kicks Off Here S How To Get A Faster Refund